doordash quarterly tax payments

I received right around 550 at the beginning of 2021. However there is one exception to this rule.

Ad Order right now and have your favorite meals at your door in minutes with DoorDash.

. If you made 5000 in Q1 you should send in a Q1. Every dollar of expense that you record reduces your taxable income. 1 day agoDoorDash Inc reported quarterly revenue on Wednesday that beat estimates as food delivery demand showed no sign of slowing indicating ordering habits have changed.

From National Restaurants to Local Favorites DoorDash Delivers the Most Restaurants. Another option is to pay quarterly estimated payments direct to the irs. To pay the estimated taxes for Q1 you must total your DoorDash income for the quarter and multiply your income by 153.

The IRS refers to them as Estimated Tax Payments. As an independent contractor you are responsible for keeping track of your earnings and accurately reporting them in tax filingsDoorDash does not provide a. I am setting aside 30 for taxes and supplies.

The answer is Yes. Doordash taxes reddit 2021 home artista doordash taxes reddit 2021. April 1 May 31.

From National Restaurants to Local Favorites DoorDash Delivers the Most Restaurants. Remember to pay the irs quarterly taxes. In most cases you must pay estimated tax for 2021 if both of the following.

If youre purely dashing as a side hustle you might only have to pay taxes one a year. Tax payment is due June 15 2021. If youre in the 12 tax bracket every 100 in expenses reduces your tax bill by 2730.

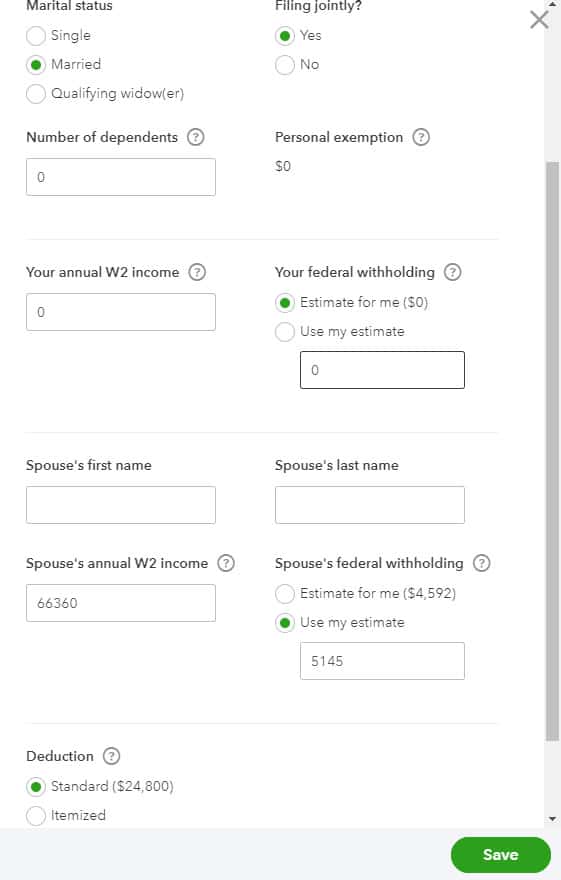

Rdoordash_drivers Live 21k. You can follow the step-by-step process of filing paying your quarterly taxes in QuickBooks Self-Employed. Expenses such as cell phone cell phone bill clothes for work etc you do not pay much in taxes.

Didnt make Quarterly Payments for DoorDash. If you expect to owe the IRS 1000 or more in taxes then you should file. Sometimes they are referred to as Quarterly tax payments.

I never made quarterly estimates payments. I have another side gig usually covered under my normal jobs W-2 withholding. If you made over 600 doing 1099 work income earned without being taxed you are required to pay.

In QuickBooks Self-Employed go to the Taxes menu. The IRS has a general rule to determine if you should make quarterly estimated tax payments in 2021. Look at it this way.

Tax payment is due April 15 2021. The total tax liability once you. Save money each week as though its your own form of withholding send in what you saved each.

Ad Order right now and have your favorite meals at your door in minutes with DoorDash. These are payments you need to be making if you are not having. I had more than 100 percent of.

A better plan is to develop an idea throughout the year of what to set aside. January 1 March 31. You just submit payments quarterly you dont do your taxes 4 times a year.

If you track your miles. You must make quarterly payments to the IRSthe threshold is 600. Just started DD and combined I think I.

More posts from the doordash_drivers community. Be aware the due dates arent exactly quarterly. One of the more serious misconceptions taxpayers may.

You must pay at least 90 of the eventual tax liability in each quarter and pay year end by January 15 of the following year to avoid a penalty.

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier

Doordash 1099 Critical Doordash Tax Information And Write Offs Ridester Com

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

A Beginner S Guide To Filing Doordash Taxes 4 Steps

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

Enjoy All The Benefits Of A Tax Professional With Xpert Taxes Get Matched With A Tax Expert Who Is Knowledgea Tax Prep Organizing Time Receipt Organization

Doordash Taxes 13 Faqs 1099 S And Income For Dashers

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

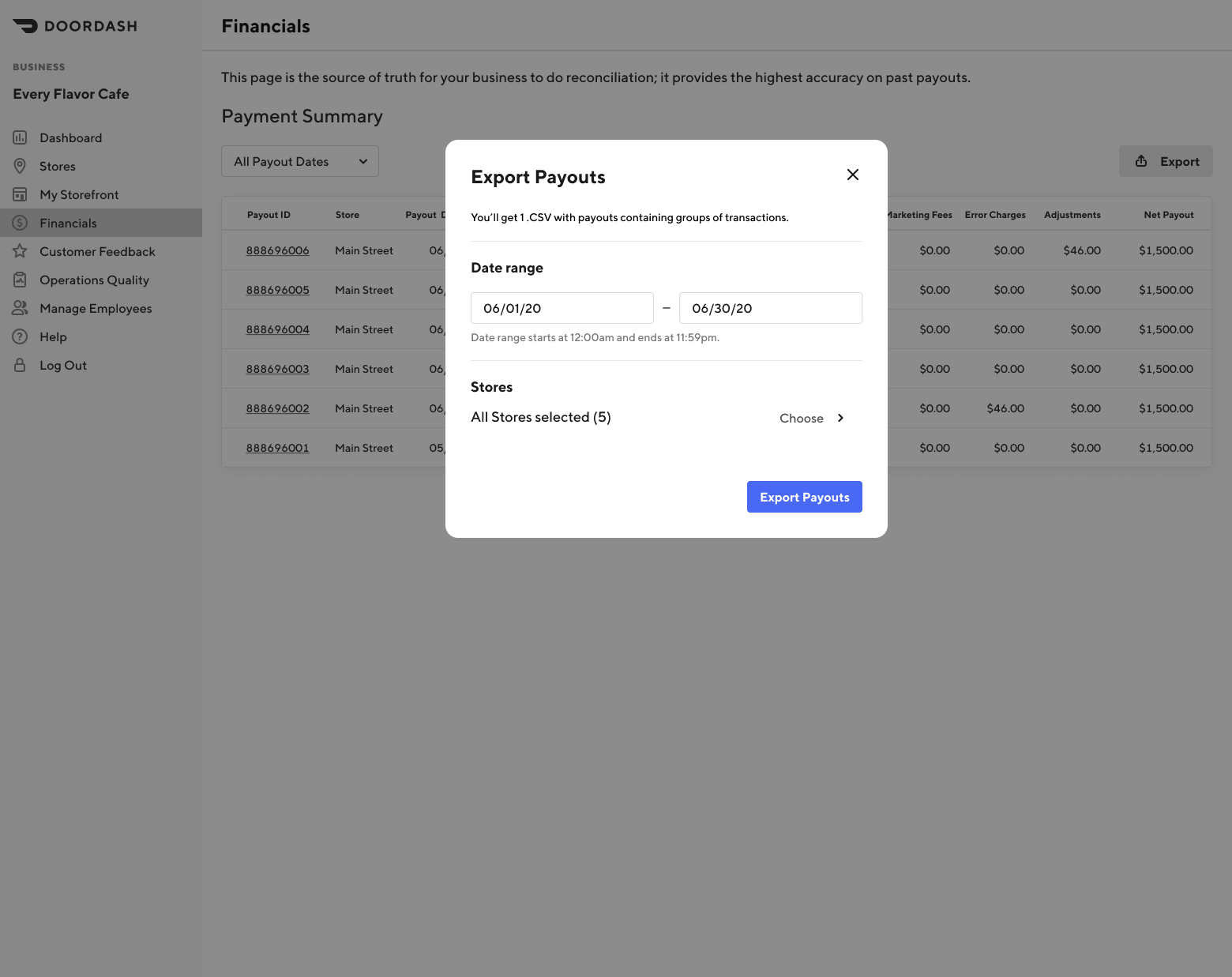

How Do I File Doordash Quarterly Taxes Due Septemb

A Beginner S Guide To Filing Doordash Taxes 4 Steps

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Prepare For Tax Season With These Restaurant Tax Tips

Do I Owe Taxes Working For Doordash Net Pay Advance

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Enjoy All The Benefits Of A Tax Professional With Xpert Taxes Get Matched With A Tax Expert Who Is Knowledgea Tax Prep Organizing Time Receipt Organization