does binance send tax forms canada

It is secure and 100 safe to trade there. If you do this through an exchange you better count on the IRS finding out.

How To Find Your Transaction History On Binance For Taxes Followchain

Binance enables exchanging cryptos for Canadians.

. Straightforward UI which you get your crypto taxes done in seconds at no cost. 50 of the gains are taxable and added to your income for that year. We explore what it offers pros and cons fees and more in our review.

You have to convert the value of the cryptocurrency you received into Canadian dollars. We have integrated Binance via API on BearTax with which one can consolidate trades review depositsreferrals calculate capital gains and download tax forms within few minutes. So when you want to download trade transactions history you would need to do so in periods from January to March April to.

They have their headquarters in Malta. Select currency payment method and withdrawal info. Low fees Binance US charges 01 transaction fees less if you pay in.

If you receive a Form 1099-K or Form 1099-B from a crypto exchange without any doubt the IRS knows that you have reportable crypto currency. Crypto back to USD yes. Binance is one of the largest and most comprehensive cryptocurrency exchanges in the world.

You will need to complete the KYC verification process to buy and sell. Here is how to withdraw money from Binance to your bank account. Cryptocurrency is taxed like any other commodity in Canada.

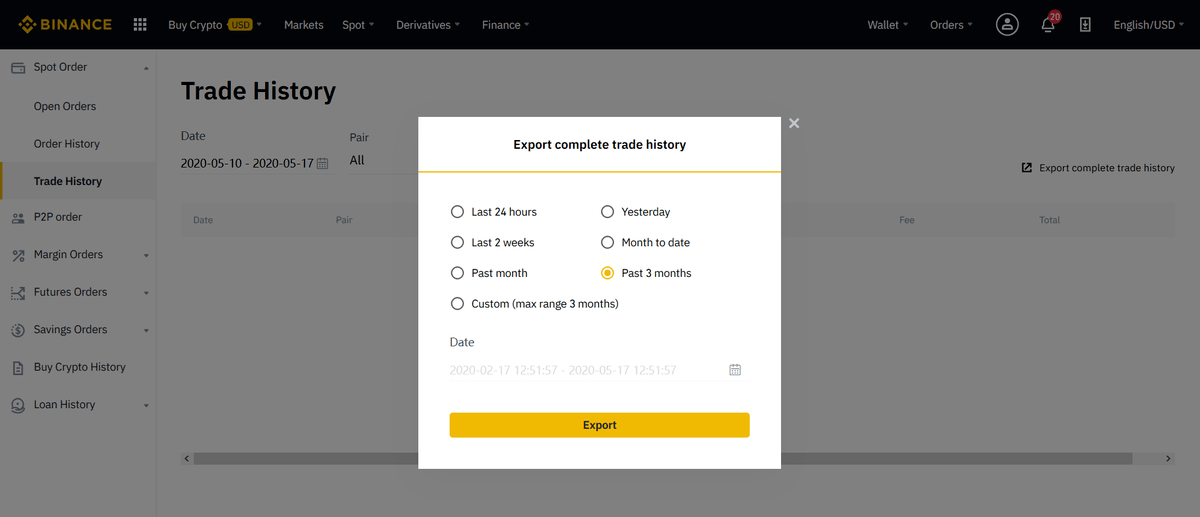

Binance allows you to generate historical reports in breakdowns of three months at a time. US taxpayers will see the following. It performs over 1400000 transactions per.

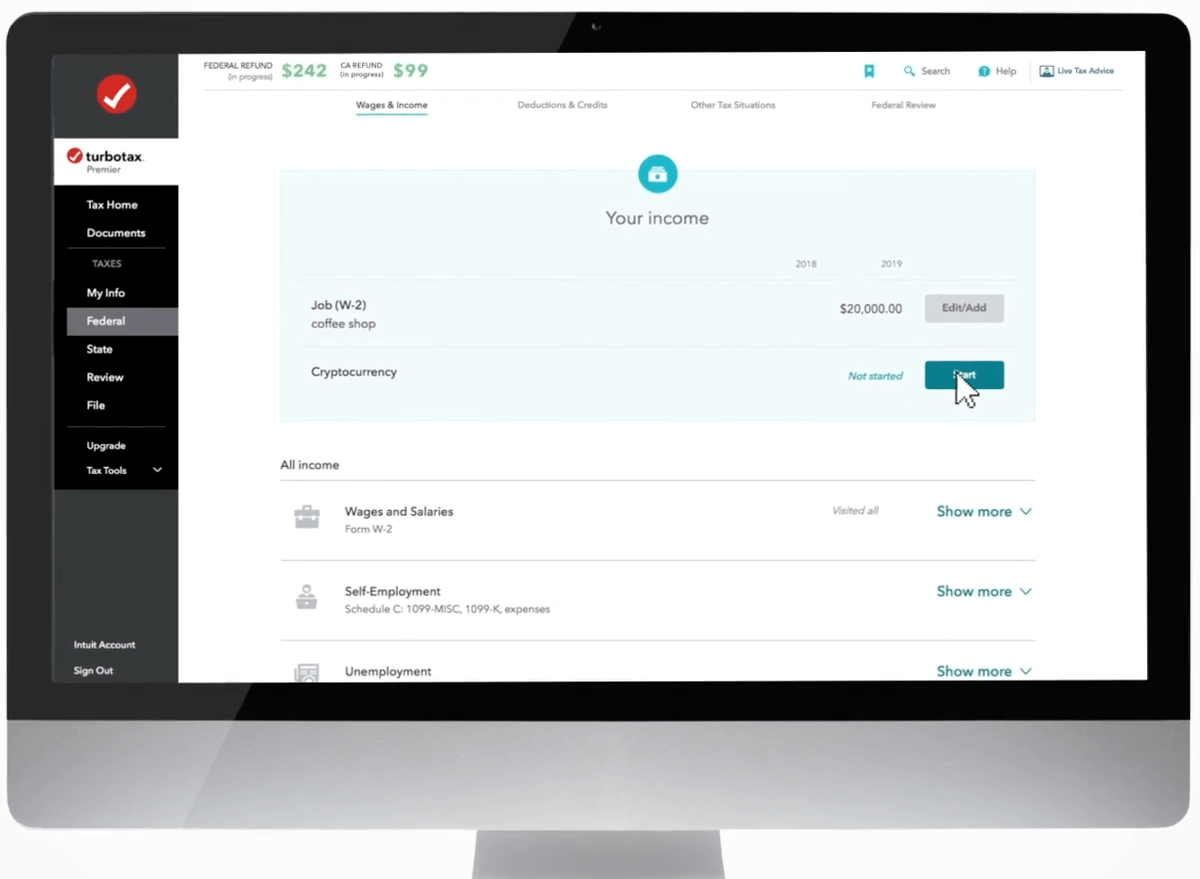

This transaction is considered a disposition and you have to report it on your income tax return. As it stands right now crypto is an asset especially if youre using it to make profits. For the 2020 tax year the US individual income-tax return Form 1040 will require taxpayers to disclose their cryptocurrency dealings.

The ownership of any investment decisions exclusively vests with you after analyzing all possible. Go to your fiat and spot wallet. Binance is ranked 19 of 199 in Canada for online crypto exchanges.

The IRS states that US taxpayers are required to report gains and losses or income earned from crypto rewards based on certain thresholds on their annual tax return Form 1040. In the summer of 2018 an international coalition of tax administratorsincluding the Canada Revenue Agency CRA and the United States Internal Revenue Service. But remember - youll only pay tax on half your.

Binance is the largest cryptocurrency exchange founded in 2017 by Changpeng Zhao. BinanceUS does NOT provide investment legal or tax advice in any manner or form. Lets say you bought a cryptocurrency for.

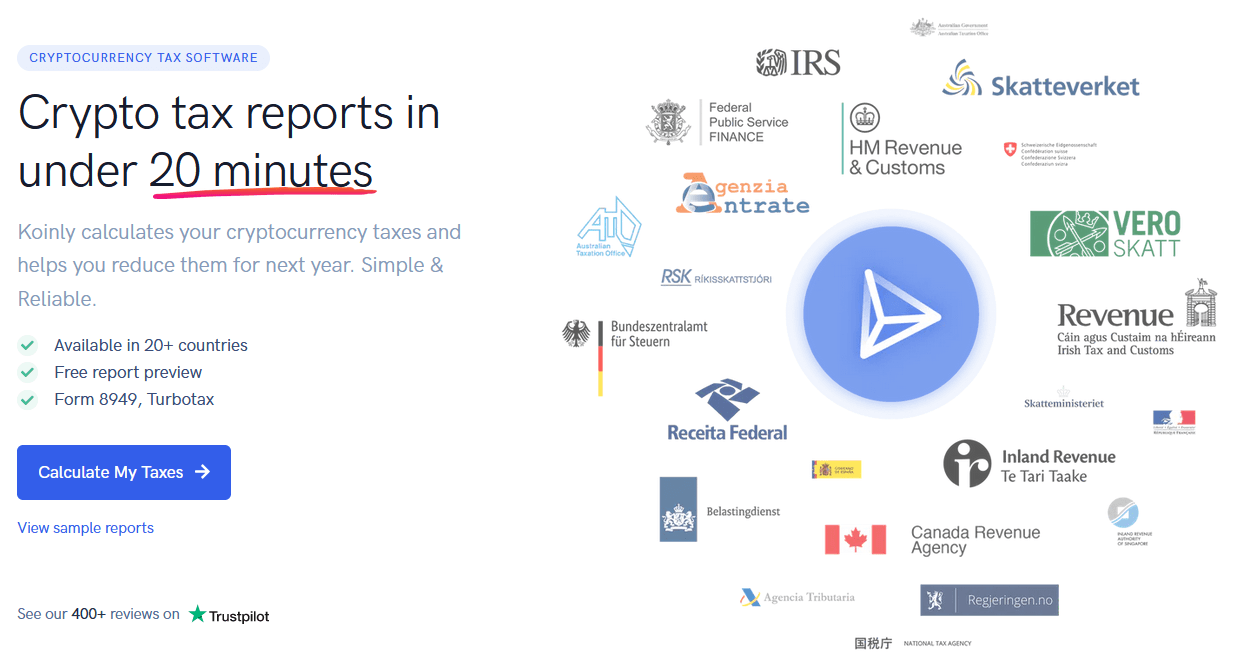

One of the largest crypto exchanges worldwide - Binance helps millions of crypto investors buy sell and trade crypto. Koinly is a Binance tax calculator reporting tool. Fast Binance US uses the same technology as Binance which processes 14 million orders per second.

Instead your crypto capital gains are taxed at the same rate as your Federal Income Tax rate and Provincial Income Tax rate. Answer 1 of 5. 1099-K 1099-B.

Binance will be launching the Tax Reporting Tool at 2021-07-28 0400 AM UTC a new API tool to allow Binance users to easily keep track of their crypto activities in order to. The most important thing in terms of Binance tax documentation is the quarterly reports you get on your activity on the exchange. In order to buy and sell cryptos across the Binance network go to the Trade dropdown menu and select P2P.

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

Free Crypto Here S 5 Ways To Earn Just By Improving Your Knowledge Koinly

5 Best Crypto Tax Software Accounting Calculators 2022

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

The Complete Pancakeswap Taxes Guide Koinly

5 Best Crypto Tax Software Accounting Calculators 2022

Binance Reopens Eur Bank Transfer Via Sepa Paysafe Partnership Paysafe

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

Itsa Now Supports Binance Smart Chain Bsc

5 Best Crypto Tax Software Accounting Calculators 2022

Binance Gets A License In Canada And Is Now A Crypto Service Provider In Bahrain Coincodecap

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

5 Best Crypto Tax Software Accounting Calculators 2022

How To Find Your Transaction History On Binance For Taxes Followchain

Binance Warns Crypto Investors Of Massive Phishing Scam Via Sms Jackofalltechs Com

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support